Arizona lawmakers brought in over $3.5 million in salary, per diem and mileage reimbursement this year.

Lawmakers all make $24,000 a year, but the real money comes from mileage reimbursement and subsistence payments.

Arizona’s lawmakers sure know how to milk a good thing. The state's legislative per diem and mileage reimbursement policy is a veritable buffet of taxpayer-funded perks, dished out with little to no questions asked.

For those legislators who reside within Maricopa County, the daily per diem is a modest $35 — until the session drags on past 120 days, after which it plummets to a paltry $10. For representatives living outside Maricopa County, the daily subsistence aligns with the six highest months of the federal per diem rate, which is a much more cushy deal at $251.66 up from $238 daily a year ago. Once the 120-day mark hits, their pay is slashed to $125.83 up from $119. These numbers are according to the records from the Arizona House.

The Arizona Mirror previously wrote about the disparity between Maricopa vs. rural lawmakers based on the 2023 numbers. Since there were many resignations this year, there are more than 90 lawmakers in the documents.

What isn’t mentioned much in coverage of the topic is lawmakers are entitled to a couple of subsistence days in the week before and after each regular session, plus a weekly subsistence day for good measure. And if they have the foresight to join an interim committee or caucus, well, that's a few more paydays right there. Some members, perhaps adept at playing the legislative game, can rake in up to six extra days of subsistence every two weeks.

But here's the kicker: this money is handed out “non-accountably.”

No need to substantiate expenses. It’s almost like a trust fund for adults — legislators, specifically. The mileage reimbursements, meanwhile, are based on actual miles traveled to the Capitol from their permanent or temporary residence, but as the courts say “residence is a state of mind.” There is no checks and balances for where the lawmaker is claiming to live. Take Sen. Wendy Rogers for example. It’s long been suspected she lives in Maricopa County, but claims an address in Flagstaff and her miles/ per diem line up to that Flagstaff address giving her thousands of more dollars every year she’s in the Legislature.

Related articles:

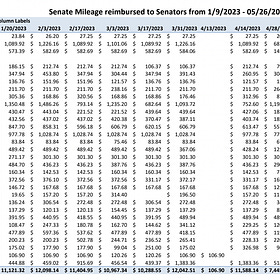

Arizona Senate mileage reimbursements

The per diem issue at the Arizona Legislature will be ongoing likely for weeks as nothing continues to happen at the Capitol except House Democrats picking their new leadership team.

Mesa lawmaker claims nearly $30,000 more in per diem and miles than she should

Correction: This story has been updated to remove a paragraph describing Jacqueline Parker buying a property in Queen Creek in 2020. A spokesman for the Arizona House tells me it’s a different Jacqueline Parker and not the lawmaker this story is about. Parker still refuses to comment for the story, but asked a spokesman to relay she wants the story to b…

Unlike subsistence, though, mileage isn’t taxable. Because why should our public servants pay taxes on their taxpayer-funded perks?

Some tidbits from the records:

The House’s total from just per diem: $575,472.88

House miles total: $131,699.22

Overall: $707,172.10.

Senate overall total: $620,954.76

Combined: ~$1.35 million. With all 90 lawmakers each earning $24,000 it would bring the overall total compensation for legislators to $3.51 million (an average of $39,000 per lawmaker) and that doesn’t even include benefits or retirement.

Sen. Brian Fernandez brought in the most money in the Senate with $54,360.20 from miles and per diem followed by: Sen. Theresa Hatathlie - $48,017.94, Sen. David Gowan - $47,022.25 Sen. Justine Wadsack - $45,808.28 and Sen. TJ Shope - $40,320.87